In a bid to be the first oil company to destroy Santa's home Royal Dutch (NYSE:RDS.A) announced it will begin test drilling north of Alaska in July. A venture that Royal thinks will be a hydrocarbon bonanza comes with plenty of risk both for the company and for cute little Coca-Cola polar bear cubs. This is mostly uncharted territory for drillers of course as it is NORTH of Alaska. Have a look at this map: (Source: Google)

In fairness to Royal here are their safety plans for the Arctic.

What to do

While we are not thrilled about Arctic drilling we actually have an ulterior motive for our "stance" on Royal here: put options. If we have a belief that a stock will go down we can profit from that and limit our downside by buying put options. Repeat: I don't actually advocate this trade (here are trades I like), I wish instead to demonstrate how to take a bearish position on a stock using put options.

So here is our "thesis": Royal Dutch's stock price will decrease significantly in the near/mid term for the following reasons:

- The Arctic will require a lot of capital expenditure

- Cheap shale energy will make Arctic drilling uncompetitive

- A lot of bad press (like this)

- Santa

Caveats

The first thing you should know about buying put options is that they are a depreciating asset all things being equal. Just like when you buy a new car it loses resale value as time passes, so it is with buying put options. Part of the value of an option is how much time it has until it expires and that means options lose value over time even as the underlying stock stays unchanged.

Most non-professional investors never consider writing (selling) options and this is a shame because being on the buying side means time is always working against you. If you are the seller time is always working for you. Nice work if you can get it. So as we explore this trade put yourself in the shoes of both parties, buyer and seller. This is probably the most important lesson an investor new to options can recognize - it is usually better to be the seller than the buyer of options.

Staying Put

Having said that, buying puts can be a profitable way to capitalize on a stock's downside, and unlike shorting a stock outright your losses cannot exceed your initial outlay. Puts also provide leverage. A put is the right but not the obligation to sell a stock at an agreed upon price until an agreed upon date. The agreed upon price is the "strike" and the date that the rights end is the "expiration."

So lets say Royal trades at $10, we buy a put for $1 with a strike of $10 and an expiration of Dec 31. This means that anytime between now and the end of the year we can execute our right to sell a share at $10. So if Royal trades at $5 this year we could exercise our right to sell at $10, netting us a $4 profit ($5 - our original $1). In practice we would sell our put to someone else who actually has shares to sell instead of exercising it but the resulting profit is the same (minus a very small percentage). In this scenario Royal dropped by 50% but your profit was 400%. This is the "leverage" of put options and is one of the advantages over shorting shares outright.

If Royal was trading at more than $10 dollars and Dec 31st came around our option would expire worthless. This is the tradeoff of put options and is the reason why people write (sell) them.

If the stock traded at a price higher than our strike then our put option would be OTM (out of the money) and in danger of expiring worthless. ITM (in the money) means the stock is trading lower than our strike price and our put has "intrinsic value." ATM (at the money) means it is at or around our strike. You see the acronyms ITM, ATM, and OTM all the time in options discussions.

Options like this also trade in lots of 100. So in the above example if a put costs $1 it really costs $100 and you get the right to sell 100 shares. Prices, however, are usually quoted per share.

The Sound of a Man Working on an Options Chain

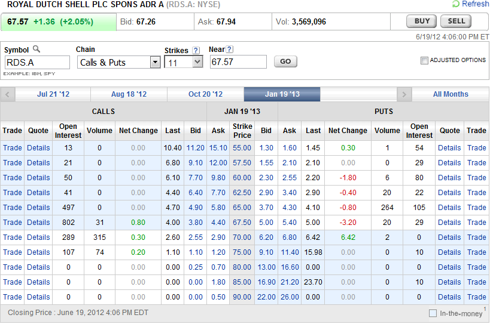

Have a look at Royal's options chain, a list of the puts and calls (not discussed here) available for Royal. (Source ETrade)

Let's have a look at the put with a strike price of $67.50. Royal last traded at $67.57 so this option is as close to ATM as you can get. A more conservative approach would be to pick an ITM put that is more expensive but is less likely to expire worthless. If we were more aggressive we could get OTM puts that would allow us to buy more puts because they are cheaper but they come with the likelihood of expiring worthless.

We'll stick with ATM. Under the "Ask" column we see $5.40. This means that someone who has enough cash to fill the order will sell us the right to sell them 100 shares of Royal between now and Jan 19 2013 (the expiration) for $540. Let's look at the details of this put being offered.

Royal last traded at $67.57 so the $67.50 put is OTM by $0.07. The entire cost of the $5.40 is the premium we pay for the 7 months we have for Santa to ruin Royal. Notice in the image the "Intrinsic Value" of N/A. If we looked at the $70 strike put it would read $2.43 because that is the amount by which it is currently ITM ($70-$67.57)

The Polar Bear Club Plunge

So let's take the plunge. We will call this the "Polar Bear" trade (it is important to name your trades). This trade will start out with an immediate paper loss, as buying a put always does. The put is being offered for $5.40 but has a bid of $5.00 if we wanted to close the trade. This is the spread and you can read here how it is related to liquidity.

Right Now the "Polar Bear" trade:

$500 off of $540 cost basis = -7.4%

Conclusion

Buying a put can be way to take a bearish position on a stock and get leverage for potentially huge gains. However, time value is a large part of the cost of buying an option and is working against us the moment we buy. We will follow the "Polar Bear" trade and see what we can learn about put options. Here are some energy names with options to consider if you feel like you see an opportunity:

Arch Coal Inc (NYSE:ACI), Alpha Natural Resources, Inc.(NYSE:ANR), Apache Corporation (NYSE:APA), Baker Hughes Incorporated (NYSE:BHI), Peabody Energy Corporation (NYSE:BTU),Chesapeake Energy Corporation(NYSE:CHK), ConocoPhillips(NYSE:COP), Chevron Corporation (NYSE:CVX),Devon Energy Corporation (NYSE:DVN), Enbridge Energy Partners, L.P.(NYSE:EEP), EOG Resources, Inc. (NYSE:EOG), Halliburton Company(NYSE:HAL), Hess Corp. (NYSE:HES), Linn Energy, LLC(NASDAQ:LINE), Marathon Oil Corporation (NYSE:MRO), National-Oilwell Varco, Inc. (NYSE:NOV), Plains All American Pipeline, L.P.(NYSE:PAA),Petroleo Brasileiro SA (ADR) (NYSE:), Penn West Petroleum Ltd (USA)(NYSE:PWE), Royal Dutch Shell plc (ADR)(NYSE:), Seadrill Ltd(NYSE:SDRL), Schlumberger Limited.(NYSE:SLB), Statoil ASA (ADR)(NYSE:STO), Suncor Energy Inc.(NYSE:SU), TOTAL S.A. (ADR) (NYSE:TOT),Valero Energy Corporation (NYSE:VLO), Exxon Mobil Corporation(NYSE:XOM)

Disclosure: I am long ACI.

Previous Article

Previous Article

Share your views...

0 Respones to "Polar Bear: Royal Dutch Will Fail In Arctic on day true story"

Posting Komentar